child tax credit payments continue in 2022

Meanwhile New Yorkers claiming the Empire State. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors.

Child Tax Credit 2022 Extension Update Is It In The Biden Plan King5 Com

As it stands right now child tax credit payments wont be renewed this year.

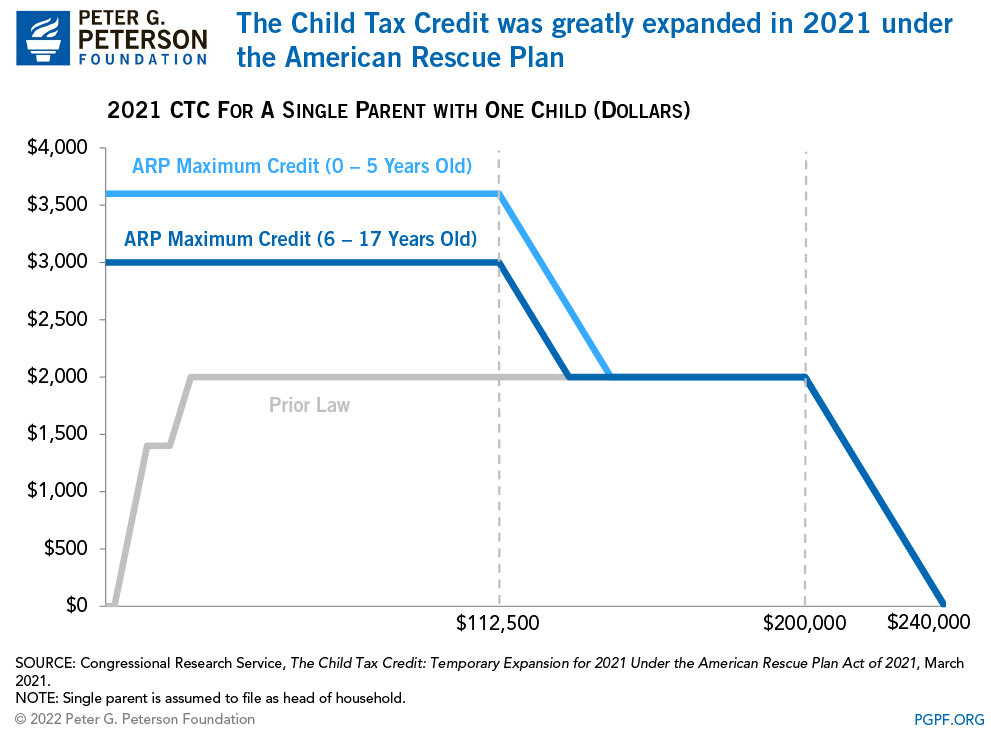

. As part of the American Rescue Act signed into law by President Joe Biden in March of 2021 the child tax credits were expanded to up to 3600 per child from the previous 2000. Now even before those monthly child tax credit advances run out the final two payments come on Nov. The payments which are capped at three children for a total of 750 started rolling out in late August.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. If a family meets the income requirements and has received each payment between July and December of this year they may receive up to 1800 for each child. For example if you received advance Child Tax Credit payments for two qualifying children properly claimed on your 2020 tax return but you no longer have qualifying children in 2021 the advance Child Tax Credit payments that you received based on those children are added to your 2021 income tax unless you qualify for repayment protection.

Child tax credit payments will revert to 2000 this year for eligible taxpayers Credit. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Will there be a child tax credit in February 2022.

In 2022 the tax credit could be refundable up to 1500 a rise from. Government disbursed more than 15 billion of monthly child tax credit payments in July to American families. If you have a child under the age of 18 with a Social Security number you qualify for the child tax credit.

Families who are eligible for the expanded credit may see more money come to them when they file their taxes this year as just half of the total. The maximum child tax credit amount will decrease in 2022. The law authorizing last years monthly payments clearly states that no payments can be made after December 31 2021.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Families in Connecticut can also claim 250 per child.

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. In Rhode Island families will get 250 per child and a maximum of 750 total for up to three children with direct payments going out beginning in October.

These payments were part of the American Rescue Plan a 19 trillion dollar. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of. 15 Democratic leaders in Congress are working to extend the benefit into 2022.

As part of a COVID relief bill Democrats increased the tax credit to 3000 per child ages 6-17 and. HOW MUCH MORE MONEY WILL I GET IN 2022. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

An expanded child tax credit would continue for another year. While not everyone took advantage of the payments which started in July 2021 and. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

Have been a US. That means the child tax credit returns to a 2000 lump sum for individuals making up to 200000 and couples filing jointly who make up to 400000 with 1400.

The Expanded Child Tax Credit About Saverlife

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

/cdn.vox-cdn.com/uploads/chorus_image/image/71300653/bigbill.0.jpg)

Will Child Tax Credit Payments Continue In 2023 The Fight Is Not Over Vox

The Monthly Child Tax Credit Payments For Parents Start Tomorrow Here S How To Check On Your Payment

Child Tax Credits Worth Up To 600 And 900 Could Be Sent To Parents In 2022 As Payments Might Double The Us Sun

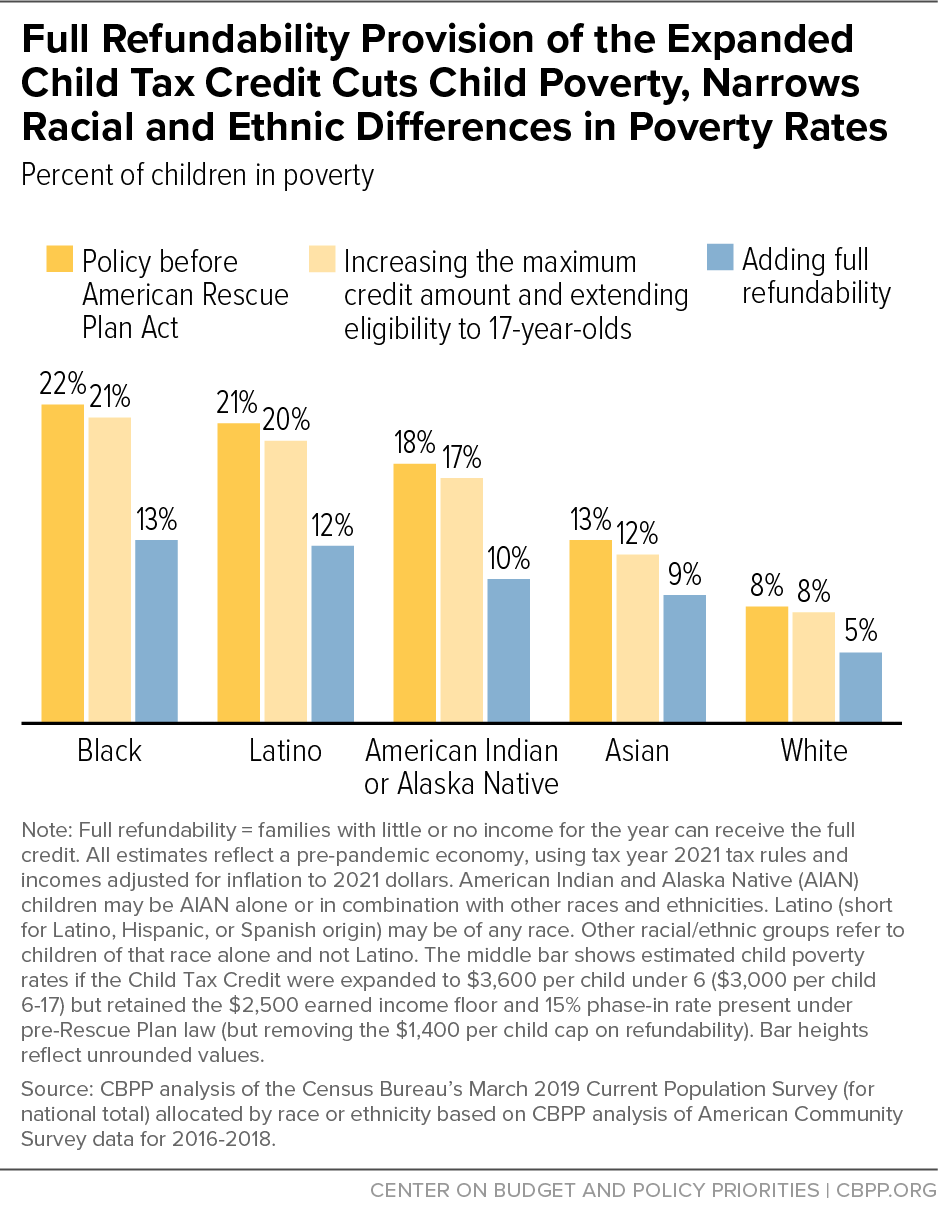

Build Back Better S Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

Child Tax Credit Will Monthly Payments Continue In 2022 Abc10 Com

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

What Are The Costs Of Permanently Expanding The Ctc And The Eitc

Get The Child Tax Credit Hawaiʻi Children S Action Network

Explaining The New 2022 Child Tax Credit And How To Claim Familyeducation

Federal Stimulus Update Will Child Tax Credit Monthly Payments Restart

Child Tax Credit Calculator How Much Will You Get From The Expanded Child Tax Credit Washington Post

The Monthly Child Tax Credit Payments Are Done Here S What Will Replace It Fortune

Will Monthly Child Tax Credit Payments Be Extended Into 2022 Fast Forward Accounting Solutions

September Child Tax Credit Payments Are Here What Happens If Irs Misses You Fingerlakes1 Com

Is The Enhanced Child Tax Credit Getting Extended This Year Here S The Latest Cnet

Will Monthly Child Tax Credit Payments Continue In 2022 Their Future Rests On Biden S Build Back Better Bill

Child Tax Credit Payments What To Expect In 2022 And How Much Nbc New York